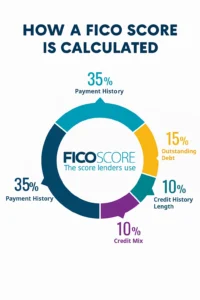

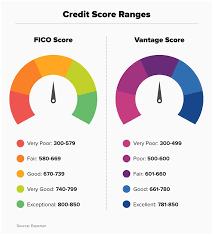

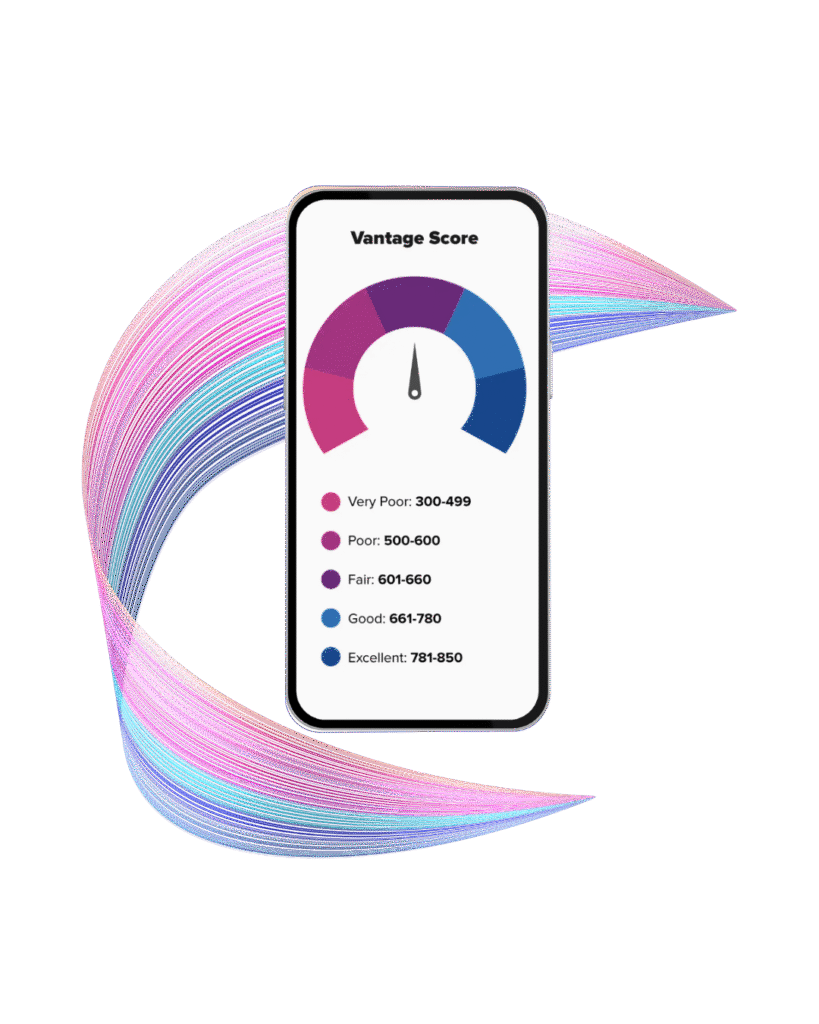

Factors That Impact Your Credit Score Factors

Factors That Impact Your Credit Score Factors Table of Contents Many people are surprised to find their credit score dropping, even when they try to manage their money well. Small mistakes, like a single late payment, can have a big and lasting impact on your credit. You may not realize how many factors actually shape […]