Living in New York means having access to endless financial opportunities—but it also comes with higher risks of credit fraud and identity theft. With scammers targeting busy city residents, protecting your credit has never been more important. Fortunately, free credit monitoring services give New Yorkers a powerful way to safeguard their financial health, catch fraud early, and stay in control—all without spending a dime.

You live in one of America’s busiest financial centers. This makes you a prime target for identity theft and credit fraud. Criminals know that New York residents often have higher credit limits and more financial accounts to exploit.

But here’s what most people don’t know: You can access powerful free credit monitoring tools right now. These services protect your financial future without costing you a penny. They watch your credit report 24/7 and send instant alerts when suspicious activity occurs.

Think about this: The average identity theft victim loses $1,343 and spends 7 hours resolving the damage. Free credit monitoring can help you catch fraud early and minimize these losses. You deserve to sleep peacefully knowing your credit health is protected.

Don’t wait until it’s too late. Take control of your credit today and discover the free monitoring options available to every New York resident.

Free credit monitoring services are tools that regularly check your credit reports and alert you to changes or suspicious activity. These services scan your credit file daily and notify you when something important happens.

Here’s how they work: The service connects to one or more of the three nationwide credit bureaus – Equifax, Experian and TransUnion. It monitors your credit profile for new credit accounts, credit inquiries, public records, address changes, and personal information updates.

Free services use “soft” credit checks that don’t hurt your credit score. This means you can check your credit as often as you want without any negative impact. The service sends you alerts via email or text when it detects changes to your credit report.

Most free credit monitoring services cover one or two credit bureaus. Paid services typically monitor all three major credit reporting agencies. However, free services still provide substantial protection for most consumers.

You get notified about new credit applications, account openings, and other important credit activity. This early warning system helps you spot signs of identity theft before major damage occurs.

Yes, free credit monitoring services can be highly effective for New York residents when used properly. Living in a high-population area like New York increases your risk of identity theft and credit fraud.

Free credit monitoring helps you stay on top of your credit activity in several ways. You receive alerts about new accounts opened in your name. The service notifies you about credit inquiries from lenders. It also tracks changes to your personal information and account balances.

Federal law protects your rights under the Fair Credit Reporting Act and FACTA. These laws ensure you can access your credit information and dispute errors. New York State also provides additional consumer protections through the Attorney General’s office.

Free services have some limitations compared to paid options. They may only monitor one or two bureaus instead of all three. You might receive fewer alerts or experience slight delays in notifications. However, free services still offer substantial protection for most people. They help you detect fraud early and take action to help protect your credit confidence.

New York residents have specific legal rights under both federal and state law for accessing free credit information. These rights ensure you can monitor your credit without paying expensive fees.

Under federal law, you’re entitled to one free credit report every twelve months from each of the three nationwide credit bureaus. You can get these reports through AnnualCreditReport.com, the only official website authorized by federal law.

Recent changes now allow you to receive free weekly credit reports from all three credit bureaus. This expanded access helps you monitor your credit more closely and catch problems faster.

New York State Attorney General resources provide additional support for credit protection. The state offers guidance on placing fraud alerts and security freezes on your credit file.

Pending legislation like NY Senate Bill 2023-S1713 would require companies to provide free credit monitoring services after data breaches. This would give victims at least one year of free monitoring to watch for identity theft.

You also have the right to dispute incorrect information on your credit report. Consumer reporting agencies must investigate disputes within 60 days and remove inaccurate information.

Here are the top free credit monitoring options available to New York residents:

AnnualCreditReport.com provides free credit reports from Equifax, Experian, and TransUnion once per year. You can now get free weekly reports online. This official site helps you avoid scams and get legitimate reports.

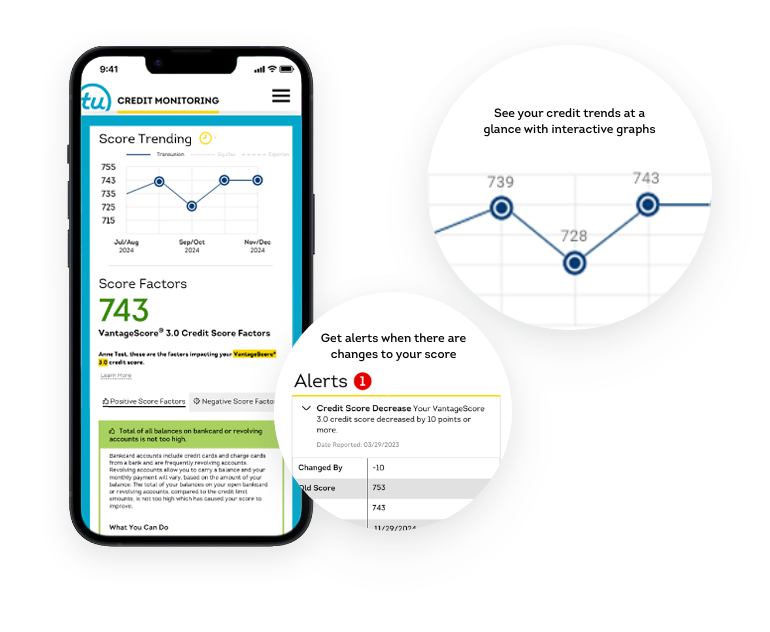

TransUnion offers free credit monitoring with daily report updates and credit score access. You receive alerts for critical changes to your TransUnion credit report. The service includes basic identity protection features.

Experian provides free credit report monitoring and alerts for changes to your Experian report. You can check your credit score and get personalized recommendations to improve your credit health.

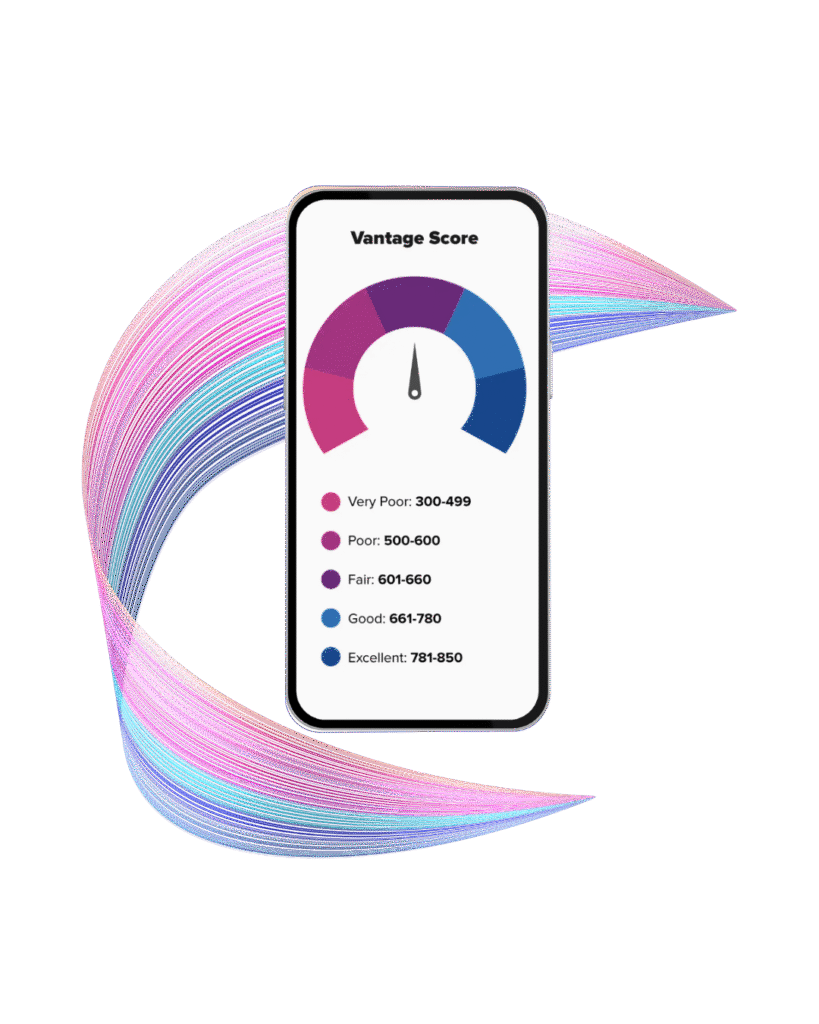

Credit Karma monitors credit changes from Equifax and TransUnion for free. The service provides alerts, credit score tracking, and educational tools. You also get access to your VantageScore® 3.0 model credit score.

SoFi offers free credit score monitoring with regular updates. The service tracks your credit profile and sends notifications about important changes. Choose services that monitor different bureaus to get comprehensive coverage. This strategy helps you catch fraud across all three major credit reporting agencies.

Getting your free credit reports is simple when you follow these steps. Start by visiting AnnualCreditReport.com, the only official website authorized by federal law.

Create an account and verify your identity using your social security number and personal information. Select which credit bureau reports you want to request. You can get one free report from each bureau every 12 months.

The website will redirect you to each credit bureau’s secure site to complete your request. Download and save your reports immediately after receiving them. Review each report carefully for errors or suspicious activity.

Take advantage of the new free weekly credit report option. This expanded access helps you monitor your credit more frequently without any cost. You can request additional free reports if you’re a victim of identity theft or fraud.

Always use the official AnnualCreditReport.com website to avoid scams. Never pay for reports that should be free under federal law. Be cautious of sites that ask for credit card information for “free” reports.

Credit monitoring services detect several warning signs that indicate potential fraud or identity theft. Watch for these critical alerts on your credit report:

Unauthorized new credit accounts opened in your name signal identity theft. Criminals often open multiple accounts quickly to maximize their theft before you notice. Unexpected credit inquiries from lenders you didn’t contact also indicate fraud.

Address changes you didn’t make suggest someone is trying to redirect your mail. This tactic helps thieves intercept new credit cards and account statements. Public record additions like bankruptcies or liens you didn’t file require immediate attention.

Changes to your personal information like phone numbers or employment details are red flags. Monitor your credit report for unfamiliar creditor names or account information. Watch for applications for credit you didn’t submit.

When you spot these warning signs, take immediate action. Contact the creditor to report fraud and close unauthorized accounts. Place a fraud alert on your credit file with all three bureaus. File a report with local police and the Federal Trade Commission. Quick response helps minimize damage and protects your financial goals from identity theft.

Free credit monitoring services cannot prevent identity theft, but they can help you detect it quickly and minimize damage. Prevention requires protecting your personal information and being cautious about sharing sensitive data.

Credit monitoring focuses on early detection rather than prevention. The service alerts you when suspicious activity appears on your credit report. This quick notification helps you respond before thieves cause extensive damage.

Early detection saves money and reduces recovery time significantly. The faster you catch identity theft, the easier it is to resolve. Most victims who detect fraud within the first few months recover more quickly.

Free services have limitations in identity theft protection. They typically don’t include identity theft insurance or full remediation services. You may need to handle dispute processes and recovery efforts yourself.

However, free monitoring still provides valuable protection for your credit health. The alerts help you stay informed about credit activity and catch problems early. This early warning system is essential for protecting your financial decisions and maintaining good credit.

Free credit monitoring services offer several key benefits for New York residents:

These services help you take control of your credit and make better financial decisions. You receive alerts about important changes that could affect your ability to apply for credit. The monitoring helps you spot errors on your credit report that could lower your score.

Free credit monitoring is especially valuable in New York’s high-risk environment. The dense population and active financial sector make residents attractive targets for identity thieves.

Free credit monitoring services have several important limitations you should understand:

The information in your credit report from different bureaus may vary. Monitoring only one bureau could miss fraud appearing on the other two reports. Consider using multiple free services to get better coverage.

You might need to upgrade to paid services if you’re at high risk for identity theft. Paid options typically include identity theft insurance and professional remediation assistance.

Setting up multiple free credit monitoring services gives you comprehensive coverage across all three nationwide credit bureaus. Here’s how to do it effectively:

Start by creating accounts with services that monitor different bureaus. Sign up for Credit Karma to monitor Equifax and TransUnion. Add Experian’s free service to cover that bureau. Include TransUnion’s direct monitoring for additional coverage.

Use different email addresses for each service to organize your alerts better. Create folders in your email to sort notifications from each monitoring service. This system helps you track which bureau reported each alert.

Set up a spreadsheet to track your monitoring services and their features. Note which bureaus each service covers and what types of alerts you receive. Review this information regularly to ensure you’re getting complete coverage.

Schedule regular times to check each service and review your credit reports. Don’t rely solely on alerts – log in monthly to review your full credit profile. This proactive approach helps you catch issues that automated systems might miss. Keep your contact information updated across all services to ensure you receive alerts promptly.

New York residents face numerous scams when seeking free credit monitoring services. Criminals target people looking for legitimate credit protection with fake websites and phishing attempts.

Avoid sites that ask for upfront payments for “free” credit reports. Legitimate free services never require credit card information for basic monitoring. Be suspicious of websites with URLs similar to but not exactly AnnualCreditReport.com.

Watch for phishing emails claiming to be from credit bureaus or monitoring services. These emails often contain links to fake websites designed to steal your personal information. Always type website addresses directly into your browser instead of clicking email links.

Scammers often promise “instant credit repair” or “guaranteed score improvements” along with free monitoring. Legitimate services focus on monitoring and education, not unrealistic promises about fixing your credit overnight.

Red flags include requests for excessive personal information beyond what’s needed for identity verification. Legitimate services only ask for basic information like your social security number and address. Be cautious of services that pressure you to sign up immediately or make urgent claims about your credit.

New York State provides strong consumer protections for residents using credit monitoring services. The state works alongside federal laws to ensure your rights are protected.

The New York State Attorney General’s office offers resources to help consumers understand their credit rights. You can access free guidance on placing fraud alerts, security freezes, and disputing errors on your credit report. The office also investigates complaints against credit reporting agencies and monitoring services.

Pending legislation like NY Senate Bill 2023-S1713 would strengthen protections for data breach victims. This bill would require companies to provide free credit monitoring services for at least one year after a breach affects your personal information.

New York State law also provides additional remedies for identity theft victims. You can place extended fraud alerts that last longer than federal minimums. The state offers resources to help you recover from identity theft and restore your credit health.

Consumer reporting agencies must comply with both federal and state requirements when operating in New York. This dual protection ensures you have multiple avenues for addressing problems with your credit file or monitoring services.

You can file complaints with both federal agencies and the New York State Attorney General if you experience problems with credit monitoring services.

Free credit monitoring services give New York residents powerful tools to protect their financial future without any cost. These services help you detect fraud early, track your credit score changes, and maintain better credit health through regular monitoring.

You have legal rights to access your credit information and monitor it regularly. Take advantage of free weekly credit reports and multiple monitoring services to get comprehensive protection. Stay vigilant about scams and always use official websites for your credit needs.

If credit issues are affecting your ability to sell your home traditionally, consider working with a reputable Finance Monitoring Guide. These companies can help you sell quickly regardless of your credit situation, giving you a fresh start on your financial journey.

Understanding what influences your credit score makes it much easier to interpret credit checks. Discover more insights and tips at the Finance Monitoring Guide.

(+1) 5165229807

info@financemonitoringguide.com

500 Marquette Ave NW, Suite 1200 Albuquerque, NM 87102 United States