In Milwaukee, WI, protecting your credit has never been more important. Identity theft and credit fraud are on the rise, with thousands of Wisconsin residents losing money and damaging their financial health every year. Criminals often use stolen personal information to open accounts, rack up debt, and destroy credit scores—leaving victims to face the consequences.

Free credit monitoring services give Milwaukee residents the tools they need to stay ahead of these threats. By tracking your credit reports and sending instant alerts about suspicious activity, these services help you catch fraud before it causes serious damage. With access to free resources from AnnualCreditReport.com, Credit Karma, Credit Sesame, and local consumer protection agencies, Milwaukee families can take proactive steps to secure their financial future.

Monitoring your credit isn’t just about protection—it’s about peace of mind. By staying informed, you gain the confidence to make smarter financial decisions while keeping your personal information safe.

Wisconsin residents face alarming identity theft rates that demand immediate attention. Recent data shows thousands of Milwaukee families suffer financial losses from undetected credit fraud each year. Your personal information and social security number remain vulnerable to criminals who steal identities daily.

Credit fraud destroys families financially when left undetected for months. Criminals open new credit accounts using your name and personal information. They damage your credit score and credit history without your knowledge. This activity on your credit reports can cost you thousands of dollars.

Free credit monitoring services offer Milwaukee residents powerful protection against these threats. These services monitor your credit reports and send alerts when suspicious activity appears. You can spot signs of identity theft before criminals cause serious damage to your credit health.

Take control of your credit today by starting to monitor your credit reports. Free credit monitoring helps protect your financial future and gives you credit confidence. Milwaukee families deserve protection from identity theft and credit fraud. Don’t wait until criminals damage your credit profile and steal your hard-earned money.

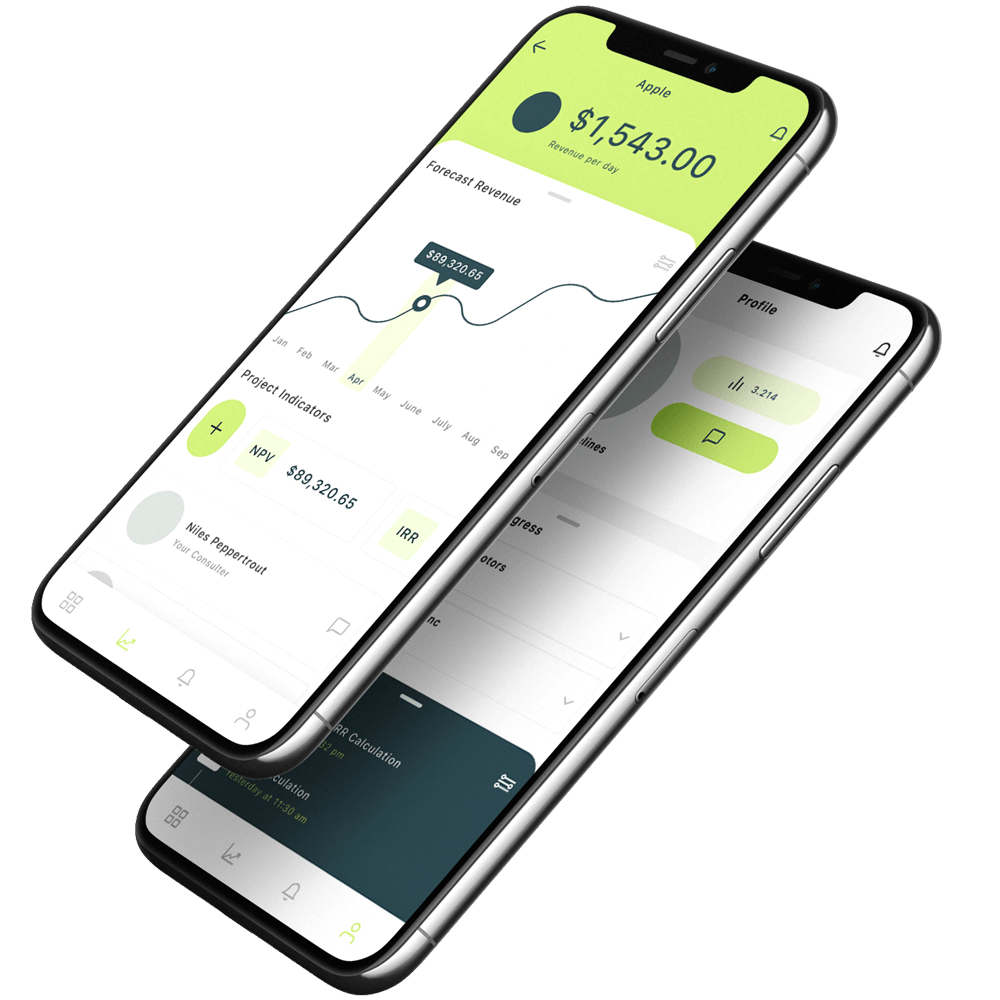

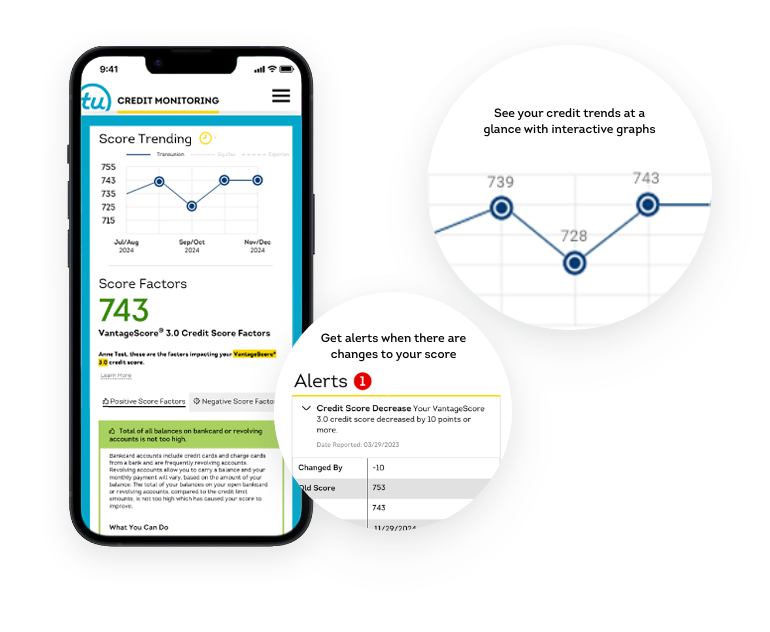

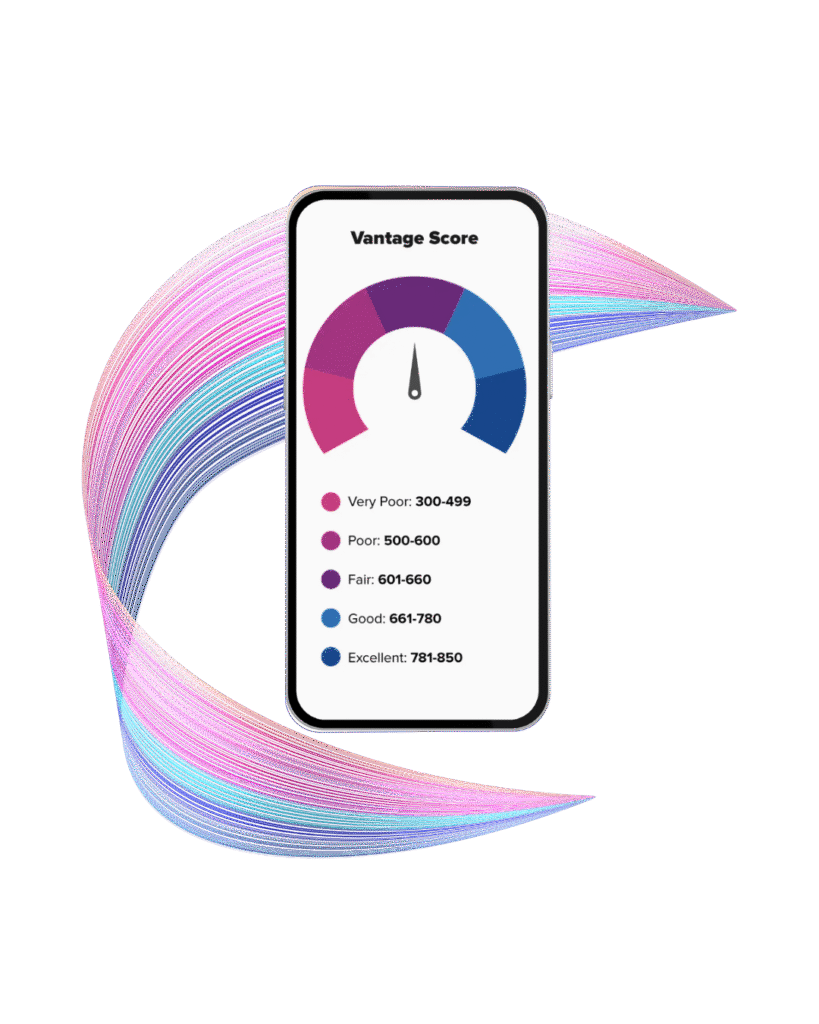

Free credit monitoring services track changes to your credit reports from major credit bureaus. These services watch your credit profile and send alerts when new information appears on your credit report. They help you stay on top of your credit by notifying you about important changes.

The three major credit bureaus – Equifax, Experian, and TransUnion – provide data to monitoring services. These companies monitor your credit reports and check for new accounts, hard inquiries, and other changes. You get notified when someone applies for credit in your name or when new credit appears.

Free services use soft inquiries to check your credit, which have no impact on your credit score. Credit monitoring has no impact on your ability to get approved for loans or credit cards. The Fair Credit Reporting Act protects your right to monitor your credit without penalties.

Free credit monitoring differs from paid premium options in several ways. Basic free services offer essential alerts and access to your free credit score. Premium services may include identity theft insurance and more detailed credit report changes tracking.

Yes, Milwaukee residents can access comprehensive credit monitoring services without paying fees. Federal law guarantees you receive one free annual credit report from each of the three credit reporting agencies. You can request your free credit report through AnnualCreditReport.com every twelve months.

Wisconsin DFI and DATCP recommend using free monitoring services to protect your credit. These state agencies point residents to AnnualCreditReport.com for their free annual credit reports. They also suggest monitoring services that help you check your credit regularly throughout the year.

Credit Karma and Credit Sesame provide free credit monitoring to Milwaukee residents. These services offer free credit reports and free credit scores from major credit bureaus. You can monitor your credit reports and get alerts about changes without paying monthly fees.

Companies that provide free credit monitoring use soft inquiries that don’t hurt your credit score. You can start monitoring your credit immediately after signing up for these services. Free weekly credit reports and alerts help you spot signs of fraud quickly.

Credit Karma offers free credit monitoring from Equifax and TransUnion credit bureaus. This service provides free credit scores, credit report changes alerts, and identity theft protection features. You can access your TransUnion credit report and monitor changes to your credit accounts regularly.

Credit Sesame delivers free credit monitoring with daily credit checks and fraud alerts. This service focuses on one major credit bureau but provides comprehensive monitoring of your credit profile. You receive notifications about new accounts and changes to your personal credit information.

Free Experian monitoring gives you access to your Experian credit report and credit score updates. Experian offers free credit monitoring services that track changes to your credit history. You can review your credit report online and get alerts about suspicious activity.

Choose your monitoring service based on which credit bureaus you want to track. Some services monitor all three credit bureaus while others focus on specific ones. Consider signing up for multiple free services to get comprehensive coverage of your credit reports from all three bureaus.

Start by requesting your free annual credit reports from AnnualCreditReport.com or call the toll free number (+1) 5165229807. Federal law requires the three credit reporting agencies to provide one free report annually. You can request all three reports at once or stagger them throughout the year.

Visit Credit Karma’s website and create your free account using your personal information. You’ll need to verify your identity by answering questions about your credit history. Credit Karma provides free credit monitoring from Equifax and TransUnion with regular alerts.

Create your Credit Sesame account to access additional free credit monitoring services. This service offers daily credit monitoring and sends alerts about changes to your credit accounts. You’ll receive notifications about new credit applications and account updates.

Request your free credit report from one credit bureau every four months for better monitoring. This strategy gives you three opportunities per year to review your complete credit profile. You can spot signs of identity theft more quickly with regular credit report reviews.

Set up calendar reminders to request your free reports throughout the year. This approach helps you maintain consistent monitoring of your credit health and financial security.

Contact the Milwaukee Police Department immediately to file an identity theft report when you discover fraud. The City of Milwaukee provides specific guidance for reporting financial crimes and identity theft. Local law enforcement coordinates with state and federal agencies to investigate these crimes.

Call the phone number of the credit bureau where you found fraudulent information on your report. Place a fraud alert on your credit reports to prevent criminals from opening new accounts. Contact the credit bureaus – Equifax, Experian, and TransUnion – to report the fraudulent activity.

Wisconsin DATCP and DFI offer resources for identity theft victims throughout the state. These agencies provide step-by-step guidance for recovering from identity theft and credit fraud. They help you understand your rights under the Fair Credit Reporting Act.

Freeze your credit reports to prevent new credit accounts from being opened without your permission. Contact creditors associated with fraudulent accounts to dispute charges and close unauthorized accounts. Document all communications and keep copies of your credit reports showing the fraudulent information.

Yes, credit freezes and fraud alerts are completely free for all Wisconsin residents. Federal law requires the three credit bureaus to provide these protective services without charging fees. You can implement these measures immediately to protect your credit from unauthorized access.

The FTC explains that credit freezes prevent most new accounts from being opened in your name. Fraud alerts require creditors to verify your identity before approving new credit applications. Both options provide strong protection against identity theft and unauthorized credit activity.

Milwaukee residents can place credit freezes through each of the major credit bureaus online or by phone. You’ll receive a PIN or password to temporarily lift the freeze when you need to apply for credit. This gives you complete control of your credit while maintaining security.

Use fraud alerts when you suspect someone may try to open credit in your name. Choose credit freezes when you want maximum protection and don’t plan to apply for credit soon. Both options work effectively to prevent criminals from damaging your credit score and credit history.

Wisconsin DATCP maintains a comprehensive breach notification database that benefits local residents. This system tracks companies that experience data breaches affecting Wisconsin consumers. You can check if your personal information was compromised in recent security incidents.

Breached companies often offer free credit monitoring services to affected customers. These offers typically include free credit reports and monitoring for one to two years. Milwaukee residents can access these services when their information appears in breach notifications.

The Consumer Financial Protection Bureau requires companies to notify consumers about data breaches promptly. Wisconsin’s system helps residents understand which breaches may affect their personal information and credit security. You can take protective action quickly when you know about potential threats.

Check Wisconsin DATCP’s breach database regularly to see if you qualify for company-provided monitoring services. Many major retailers, healthcare providers, and financial institutions offer free monitoring after security incidents. These services supplement your regular credit monitoring efforts.

Milwaukee Police Department’s Financial Crimes Unit specializes in identity theft and financial fraud cases. They provide telephone reporting options and detailed guidance for filing police reports. Local officers understand the specific challenges Milwaukee residents face with identity theft.

The City of Milwaukee offers comprehensive identity theft reporting procedures and documentation requirements. They coordinate with state and federal agencies to ensure proper investigation of financial crimes. Local law enforcement provides essential support for victims throughout the recovery process.

Milwaukee residents can access specialized support through the Financial Crimes Unit’s dedicated phone lines. Officers help victims understand the steps needed to restore their credit and recover from identity theft. They provide official police reports needed for disputing fraudulent accounts.

Local law enforcement works closely with Wisconsin DATCP and federal agencies on identity theft cases. This coordination ensures Milwaukee victims receive comprehensive support and proper investigation of their cases. Police reports help establish the timeline and scope of identity theft incidents.

Free credit monitoring helps protect your financial future without straining your budget. These services provide essential protection that every Milwaukee resident deserves. You can maintain control of your credit while building credit confidence through regular monitoring.

Free services provide essential monitoring but may require paid upgrades for advanced features. Most Milwaukee residents find free monitoring sufficient for detecting identity theft and credit fraud. Consider your specific needs when deciding between free and paid monitoring options.

Set realistic expectations about what free monitoring can and cannot prevent completely. These services excel at detection and alerts but cannot stop all forms of identity theft. Combine free monitoring with other protective measures like credit freezes for maximum security.

Free credit monitoring services provide essential protection for Milwaukee residents against identity theft and credit fraud. These services help you maintain control of your credit while building the credit confidence needed for financial success. Regular monitoring protects your credit score and credit history from unauthorized changes.

Key free resources include AnnualCreditReport.com for your annual credit reports and services like Credit Karma for ongoing monitoring. Wisconsin DATCP and DFI provide additional guidance and support for residents concerned about identity theft. The Milwaukee Police Department offers local support when you become a victim of financial crimes.

Take action today by checking your credit score and requesting your free credit report. Sign up for free credit monitoring services to receive alerts about changes to your credit accounts. Start monitoring your credit reports regularly to spot signs of fraud before criminals cause serious damage.

Don’t wait until identity thieves damage your credit profile and steal your financial security. Milwaukee residents deserve protection from credit fraud and identity theft. Take the first step toward better financial security by accessing your free credit monitoring services today.

New York State provides strong consumer protections for residents using credit monitoring services. The state works alongside federal laws to ensure your rights are protected.

The New York State Attorney General’s office offers resources to help consumers understand their credit rights. You can access free guidance on placing fraud alerts, security freezes, and disputing errors on your credit report. The office also investigates complaints against credit reporting agencies and monitoring services.

Pending legislation like NY Senate Bill 2023-S1713 would strengthen protections for data breach victims. This bill would require companies to provide free credit monitoring services for at least one year after a breach affects your personal information.

New York State law also provides additional remedies for identity theft victims. You can place extended fraud alerts that last longer than federal minimums. The state offers resources to help you recover from identity theft and restore your credit health.

Consumer reporting agencies must comply with both federal and state requirements when operating in New York. This dual protection ensures you have multiple avenues for addressing problems with your credit file or monitoring services.

You can file complaints with both federal agencies and the New York State Attorney General if you experience problems with credit monitoring services.

Free credit monitoring services give New York residents powerful tools to protect their financial future without any cost. These services help you detect fraud early, track your credit score changes, and maintain better credit health through regular monitoring.

You have legal rights to access your credit information and monitor it regularly. Take advantage of free weekly credit reports and multiple monitoring services to get comprehensive protection. Stay vigilant about scams and always use official websites for your credit needs.

If credit issues are affecting your ability to sell your home traditionally, consider working with a reputable Finance Monitoring Guide. These companies can help you sell quickly regardless of your credit situation, giving you a fresh start on your financial journey.

Understanding what influences your credit score makes it much easier to interpret credit checks. Discover more insights and tips at the Finance Monitoring Guide.

(+1) 5165229807

info@financemonitoringguide.com

500 Marquette Ave NW, Suite 1200 Albuquerque, NM 87102 United States