Living in Chicago means facing financial challenges that go beyond the everyday hustle. With identity theft striking 1 in 4 Chicago residents each year, keeping an eye on your credit has never been more important. The good news? You don’t need to spend hundreds of dollars to protect yourself. Free credit monitoring services in Chicago, IL give you instant alerts about suspicious activity, access to your credit report and score, and peace of mind—without monthly fees. Whether you’re guarding against fraud, rebuilding your credit, or just staying informed, these no-cost tools make financial protection simple, smart, and accessible to everyone in the city.

Attention: Identity theft strikes one in four Chicago residents annually, yet most pay hundreds for credit monitoring they can’t afford. Interest: You deserve protection without the premium price tag that drains your budget each month. Desire: Free credit monitoring services exist right here in Chicago IL, offering real protection for your credit score and personal information. Action: Stop paying for what you can get free – discover these no-cost options available in your city today.

Chicago residents face unique financial challenges, but protecting your credit report shouldn’t add to them. Free credit monitoring services help you stay on top of your credit health without monthly fees. These services monitor your credit profile and send alerts when suspicious activity occurs. You can check your credit score regularly and get notified about changes to your credit history.

The three nationwide credit bureaus offer various free options to Illinois residents. You can monitor your credit through legitimate services that use soft inquiries, which don’t affect your credit score. These tools help detect signs of identity theft before major damage occurs. Your social security number and personal information deserve protection that doesn’t cost money.

Free credit monitoring services track changes to your credit report and alert you about suspicious activity. These services typically monitor one credit bureau like TransUnion, providing regular updates about your credit profile. You receive notifications when new credit accounts open in your name or when hard inquiries appear on your report.

Most free services use soft credit pulls to check your information without impacting your credit score. They monitor key elements like new credit applications, account information changes, and potential fraud indicators. You can access your free credit score through these platforms and track improvements over time.

The monitoring service sends alerts via email or mobile app when significant changes occur. You’ll get notified about new accounts, credit inquiries, or suspicious activity that could indicate identity theft. These services help you stay informed about your credit health and take action to help protect your financial future.

Free credit monitoring typically covers basic features like score tracking and change alerts. However, you might receive offers for premium versions with additional protection features. You can decline these upsells and continue using the free version that meets your basic monitoring needs.

Yes, several credit monitoring options are truly free for Chicago IL residents, though some have limitations. Many services offer genuine free credit monitoring with no hidden fees or required upgrades. However, you should be aware that some companies use free services to upsell premium versions.

Federal law guarantees every Illinois resident one free credit report annually from each of the three bureaus. You can order your free annual credit report through AnnualCreditReport.com, which is the official government-authorized website. The Illinois Attorney General’s office provides guidance on accessing these free reports safely.

Statistics show that 73% of free credit monitoring services attempt to upsell users to paid versions within 30 days. You can ignore these offers and continue using the free features that provide basic protection. The key is understanding what you get with free services versus premium options.

Be cautious of impostor sites that claim to offer free credit reports but require payment information. Always use AnnualCreditReport.com for your official free reports, or contact the bureaus directly using their toll-free telephone number. These legitimate sources help protect your personal information while providing the free copy of your credit report you’re entitled to receive.

Most free credit monitoring services monitor only one credit bureau rather than all three nationwide credit reporting agencies. TransUnion, Experian, and Equifax each offer different levels of free monitoring coverage to Chicago residents. This single-bureau approach means you might miss important changes reported to other bureaus.

Credit Karma provides free monitoring for two bureaus – Equifax and TransUnion – but doesn’t cover Experian. TransUnion offers free daily credit monitoring through their own platform, while Experian provides free alerts for changes to your Experian credit report. Credit Sesame focuses primarily on TransUnion data for their free monitoring service.

The three bureaus don’t always share identical information, so monitoring all three provides complete protection. Each bureau may have different account information, inquiries, or personal details on file. Identity thieves might target specific bureaus, making comprehensive monitoring more effective.

You should consider using multiple free services to cover all three bureaus effectively. This approach helps you detect fraud across your entire credit profile without paying for premium services. You can sign up for free monitoring from each bureau directly or use combination services that cover multiple bureaus.

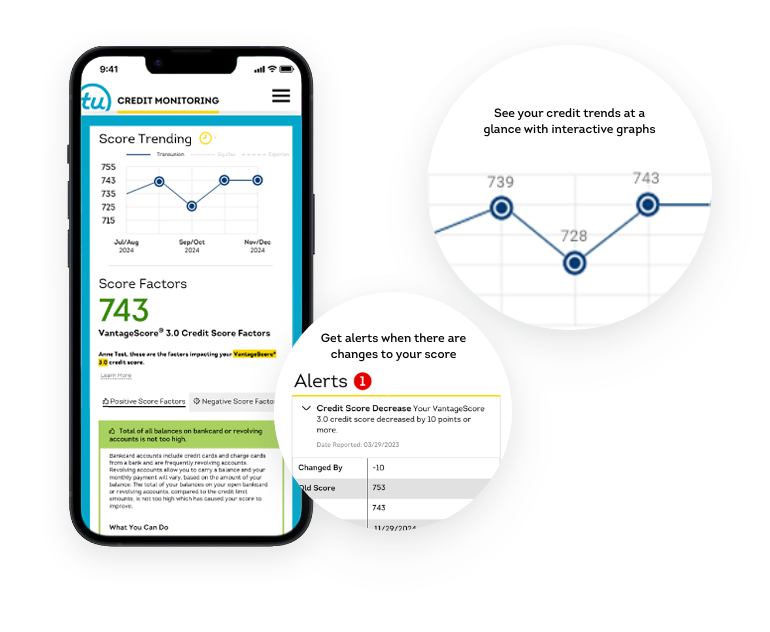

TransUnion Free Credit Monitoring provides daily credit reports and scores with alerts for critical changes. You receive notifications when new accounts open or when significant score changes occur. This service covers only TransUnion data but offers comprehensive monitoring within that bureau.

Experian Free Monitoring sends alerts for changes to your Experian credit report and helps detect potential fraud. You can access basic credit information and receive notifications about suspicious activity. The service focuses on Experian data exclusively but provides reliable monitoring for that bureau.

Credit Karma offers free credit monitoring for both Equifax and TransUnion, making it popular among consumers. You get weekly credit score updates and can track changes to your credit profile over time. The platform provides educational resources and personalized offers based on your credit information.

Credit Sesame delivers free credit monitoring based on your TransUnion report with regular alerts for changes. You can access your credit score and receive notifications about new accounts or inquiries. The service includes identity monitoring features and helps you understand factors affecting your credit health.

These services use the VantageScore® 3.0 model or similar scoring models to calculate your credit score. You can evaluate your credit confidence and track improvements as you pay your bills on time. Each platform offers mobile apps for convenient access to your credit information and monitoring alerts.

Yes, many local banks and credit unions in Chicago IL offer free credit monitoring to their customers and members. These financial institutions provide monitoring services as part of their customer benefits package. You typically need to be an existing customer or member to access these free monitoring tools.

Belmont Bank & Trust offers “Credit Sense” free credit monitoring through their mobile app to customers. This service provides credit reports, scores, and alerts for account changes or suspicious activity. Healthcare Associates Credit Union and other local credit unions often provide similar member benefits.

These institution-based services are usually available only to customers who maintain accounts or memberships. You can access monitoring features through online banking platforms or dedicated mobile apps. The coverage typically includes one bureau monitoring with basic alert features.

Contact your local Chicago credit unions to ask about member perks and identity protection tools. Many institutions offer these services but don’t actively promote them to customers. You might discover valuable free monitoring options already available through your existing banking relationships.

Blue Cross Blue Shield of Illinois (BCBSIL) members receive exclusive access to Experian IdentityWorks at no additional cost. This comprehensive benefit includes credit monitoring, identity restoration services, and up to $1 million identity theft insurance coverage. The service monitors your credit report and personal information across multiple databases.

BCBSIL members can access daily credit monitoring, dark web surveillance, and identity restoration support. You receive alerts about changes to your credit report and potential misuse of your personal information. The service includes professional assistance if you become a victim of identity theft.

This benefit represents one of the most comprehensive free options available to Chicago residents. The coverage extends beyond basic credit monitoring to include full identity protection services. You get access to identity restoration specialists who help resolve issues if fraud occurs.

To access this benefit, you must be an active BCBSIL health insurance member. You can enroll through the BCBSIL website or member portal to activate your free monitoring services. This exclusive benefit provides premium-level protection at no cost to eligible members.

The Illinois Attorney General’s “Savvy Consumer’s Checklist” confirms that every Illinois resident can access free credit reports annually. You’re entitled to one free copy of your credit report from each of the three bureaus every 12 months. This federal law ensures you can monitor your credit history without paying fees.

You can access your free reports through three official methods: AnnualCreditReport.com, by phone, or through mail. The website provides the most convenient access to your reports from all three bureaus. You can also call the toll-free telephone number or mail your request using the official forms.

Be careful of fake websites that claim to offer free credit reports but require payment information. These impostor sites often sell the information you provide or charge hidden fees for services. Always use AnnualCreditReport.com as the only authorized source for your official free annual reports.

Legitimate free credit report sites never require credit card information upfront. If a site asks for payment details for a “free” report, it’s likely fraudulent. Stick to official sources and verified services to protect your personal information and avoid unnecessary charges.

Free services typically provide alerts rather than continuous real-time monitoring of your credit profile. You might receive weekly or monthly updates instead of daily monitoring that premium services offer. The alerts focus on significant changes like new accounts, hard inquiries, or potential fraud indicators.

Most free monitoring services cover basic credit report changes but don’t include advanced features. You won’t get detailed analysis of scoring factors or personalized recommendations for credit improvement. The free versions focus on detection rather than comprehensive credit management tools.

Understanding these limitations helps you set realistic expectations for free credit monitoring services. You can still detect major issues like identity theft or unauthorized accounts opening in your name. For basic protection and awareness of credit report changes, free services provide valuable monitoring capabilities.

While specific nonprofit credit monitoring services are limited in Chicago IL, several local organizations provide financial counseling and credit education. These nonprofits teach residents how to monitor their credit effectively using free resources. You can learn about credit monitoring basics and identity protection strategies through community programs.

Contact local Chicago credit unions about member-specific programs that include credit monitoring benefits. Many credit unions offer financial education workshops that cover credit monitoring techniques. These institutions often provide resources to help members understand and protect their credit health.

Community financial education programs throughout Chicago teach residents about free credit monitoring options. You can attend workshops that explain how to access your free annual reports and use monitoring services effectively. These programs help you understand your rights and available resources for credit protection.

Check with local consumer protection agencies for additional resources and guidance on credit monitoring. The Illinois Attorney General’s office provides information about legitimate free credit services and fraud prevention. These agencies can direct you to reliable resources for protecting your credit and personal information.

Determine what type of monitoring coverage you need based on your credit situation and risk factors. Consider whether you need basic change alerts or more comprehensive monitoring features. Think about how often you want to check your credit score and receive updates about your credit profile.

Look for services that monitor multiple bureaus rather than just one credit reporting agency. Credit Karma covers two bureaus while most other free services monitor only one. You might need to use multiple services to get complete coverage of all three bureaus.

Compare alert types, mobile app functionality, and identity theft protection features across different services. Some platforms offer educational resources and personalized offers based on your credit information. Look for services that provide actionable insights about improving your credit health.

Explore credit monitoring options available through your bank accounts or credit union memberships. Local financial institutions often provide free monitoring services to customers and members. These options might offer better customer service and integration with your existing banking relationships.

Chicago residents have multiple free credit monitoring options available through national services and local financial institutions. Federal law guarantees free annual reports while various companies offer ongoing monitoring at no cost to consumers. You can protect your credit health without paying monthly fees for basic monitoring services.

Start with one of the mentioned free services today to begin monitoring your credit report and score. Explore local credit union options for additional member benefits and comprehensive financial protection. Your credit deserves protection, and these free resources make it accessible to every Chicago resident.

Take action now to secure your financial future through free credit monitoring services available in Chicago IL. You have the tools and resources needed to detect fraud, monitor changes, and maintain good credit health. Don’t wait – begin protecting your credit today with these no-cost monitoring options.

Understanding what influences your credit score makes it much easier to interpret credit checks. Discover more insights and tips at the Finance Monitoring Guide.

(+1) 5165229807

info@financemonitoringguide.com

500 Marquette Ave NW, Suite 1200 Albuquerque, NM 87102 United States