In today’s digital world, your financial security is constantly under threat—especially in a busy city like Boston. Identity theft, data breaches, and online scams are no longer rare incidents but everyday risks that can drain your bank account and destroy your credit score. Massachusetts residents, however, have stronger protections than many realize. Both federal and state laws guarantee access to free credit monitoring services, giving you the power to spot fraudulent activity before it causes serious damage. These services act as your first line of defense—alerting you when someone tries to open accounts in your name, protecting your credit score, and preserving your financial future. Whether you’re safeguarding your family’s finances or preparing for big investments like buying a home, free credit monitoring is an essential tool every Boston resident should take advantage of right now.

You face growing threats from identity theft and credit fraud every single day. Boston residents lose thousands of dollars annually to financial crimes that could be prevented. Your personal information becomes vulnerable through data breaches, stolen mail, and online scams.

Massachusetts law provides powerful protections that most residents don’t know about. You have legal rights to free credit monitoring services under federal and state regulations. These services can save you from financial disaster and protect your future.

Free credit monitoring alerts you to suspicious credit activity before damage occurs. You get notified when someone tries to open new credit accounts in your name. This early warning system protects your credit score and prevents costly fraud cleanup.

Your financial future depends on taking action today. Massachusetts residents have access to comprehensive free credit monitoring through multiple sources. You can protect your credit without paying expensive monthly fees.

Don’t wait until identity theft destroys your credit profile. Take advantage of your legal rights to free credit monitoring services right now. Your credit health and financial security depend on the steps you take today.

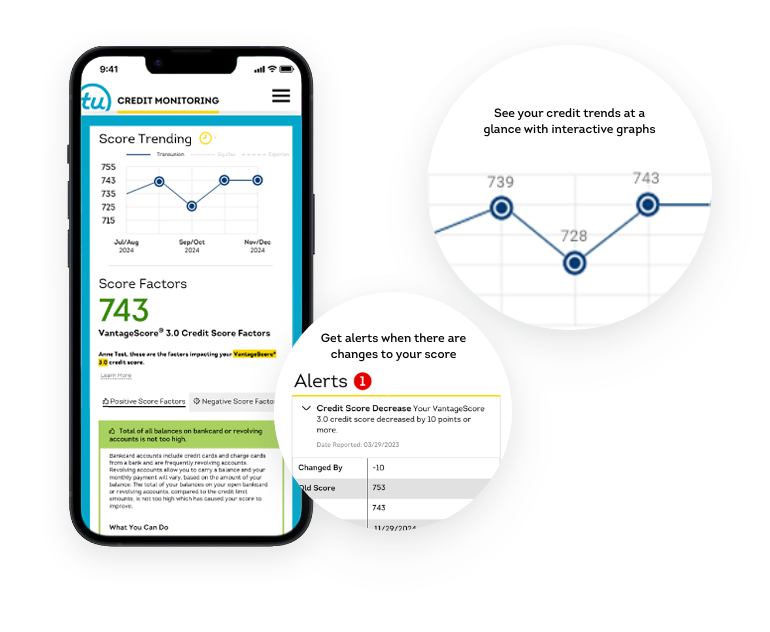

Free credit monitoring services track changes to your credit report and alert you to suspicious activity. These services monitor your credit file across the three major credit bureaus continuously. You receive notifications when new credit accounts appear or when creditors make inquiries.

The Fair Credit Reporting Act guarantees your right to monitor your credit through authorized services. Massachusetts Attorney General guidelines support these federal protections for all residents. You can access free credit monitoring without providing a credit card or paying fees.

Credit monitoring services work by scanning your credit report for specific changes daily. You get alerts when someone applies for credit using your social security number. The system also notifies you about changes to account information or personal data.

These services help you verify your identity and protect you from fraud effectively. You receive notifications through email or text when suspicious credit activity occurs. This allows you to contact the credit bureau immediately to dispute unauthorized accounts.

Massachusetts residents benefit from enhanced protections under state data breach notification laws. Companies must offer free credit monitoring service when your personal information gets exposed. This additional layer of protection helps safeguard your credit profile from potential misuse.

Yes, Boston residents have guaranteed rights to free annual credit reports under federal law. The Fair and Accurate Credit Transactions Act provides one free credit report annually from each major credit bureau. You can access these reports through AnnualCreditReport.com without any cost or obligation.

The three major credit bureaus – Experian, Equifax, and TransUnion – must provide free reports yearly. You don’t need to provide a credit card or sign up for paid services. Massachusetts Secretary of State guidance confirms these federal rights for all state residents.

Your free annual credit report includes complete information about your credit history and accounts. You can review account information, payment history, and any negative information affecting your credit score. This comprehensive report helps you understand your complete credit profile.

Federal law also allows you to request your free report within 60 days of certain events. You can get a copy of your credit report after being denied credit or employment. These additional rights ensure you stay informed about information in your credit report.

Massachusetts law reinforces these federal protections and adds state-specific benefits. You have the right to dispute inaccurate information and request corrections from creditors. These combined protections give Boston residents powerful tools to maintain healthy credit.

Experian provides free credit monitoring that includes alerts for changes to your Experian credit report. You receive notifications when new accounts appear or when creditors check your credit. This service monitors your credit activity without requiring a credit card for signup.

TransUnion offers free daily credit score monitoring and critical alerts for your TransUnion profile. You get access to your credit report and score updates regularly. The service includes monitoring of changes to personal information and new credit applications.

Both services protect your credit by sending alerts about suspicious activity immediately. You get notified when someone tries to use credit in your name fraudulently. These free services help you catch signs of identity theft before serious damage occurs.

No credit card is required to access these basic free monitoring services from major bureaus. You can sign up online and start receiving alerts within days. These services complement your free annual reports by providing ongoing monitoring throughout the year.

The three nationwide credit bureaus each offer different levels of free monitoring services. You can combine multiple free services to get comprehensive coverage of your credit file. This approach maximizes your protection without paying for expensive premium services.

Massachusetts Attorney General affirms your federal right to free annual credit reports from all three major credit bureaus. You can access one free copy of your credit report yearly from each bureau. State guidance directs residents to use secure websites like AnnualCreditReport.com for safe access.

You can place fraud alerts on your credit file free of charge in Massachusetts. These alerts require creditors to verify your identity before approving new credit applications. Credit freezes are also available at no cost to prevent unauthorized access to your credit report.

Active duty military personnel receive enhanced protections including free electronic credit monitoring services. You can request these services to protect your credit while deployed or stationed away from home. Massachusetts law ensures military families have access to comprehensive credit protection.

Massachusetts data breach notification law requires companies to provide free credit monitoring after exposing personal information. You receive free monitoring services when your social security number or personal identifying information gets compromised. This protection lasts for a defined period to help you monitor potential misuse.

Companies must notify you within a reasonable time when data breaches occur. You have the right to request specific information about what personal data was exposed. This transparency helps you understand your risk level and take appropriate protective measures.

Boston Credit Score gain significant advantages from free credit monitoring services that protect their Credit Score investments:

Good credit monitoring helps with Credit Score transactions by maintaining your creditworthiness throughout the process. You avoid surprises during mortgage underwriting that could delay or cancel home purchases. Lenders require stable credit profiles, and monitoring helps you maintain consistency.

Credit health directly impacts your ability to access Boston’s competitive Credit Score market. You need excellent credit to qualify for the best mortgage rates and terms. Free credit monitoring helps you protect the credit profile necessary for successful Credit Score transactions.

Finance benefit from monitoring services that protect home equity and property values indirectly. Identity theft can damage your credit so severely that refinancing becomes impossible. This protection preserves your ability to access home equity when needed for improvements or emergencies.

Free credit monitoring connects directly to Credit Score opportunities by maintaining your qualification status. You stay ready to act quickly in Boston’s fast-moving Credit Score market. Good credit monitoring ensures you don’t miss opportunities due to unexpected credit problems.

Yes, Massachusetts law requires companies to provide free credit monitoring services after certain data breaches. The amended data breach notification law mandates this protection when social security numbers or personal identifying information gets exposed. You receive these services automatically without requesting them.

Companies must offer comprehensive monitoring services that include alerts and credit report access. You get protection for a specific time period that allows you to monitor potential misuse. This coverage includes monitoring across multiple credit bureaus to ensure complete protection.

The law requires businesses to provide clear information about what personal data was compromised. You receive details about the type of information exposed and the potential risks involved. This transparency helps you understand what additional protective measures you might need.

Massachusetts residents benefit from some of the strongest data breach protection laws in the country. You have legal recourse if companies fail to provide required free credit monitoring services. These protections ensure you receive the monitoring services you’re entitled to under state law.

Visit AnnualCreditReport.com to request your free annual credit report from each major credit bureau. You can get one free report from Experian, Equifax, and TransUnion every twelve months. Verify your identity using your social security number and personal information to access your reports securely.

Review each credit report carefully to check for inaccurate information or signs of identity theft. Look for unfamiliar accounts, incorrect personal data, or suspicious credit activity. Contact the credit bureau immediately if you find errors or unauthorized accounts.

Create free accounts with TransUnion and Experian to access their complimentary monitoring services. You don’t need to provide a credit card or commit to paid services. These accounts give you ongoing access to credit scores and monitoring alerts.

Set up your alert preferences to receive notifications about important changes to your credit file. You can choose email or text alerts for new accounts, credit inquiries, or personal information changes. Customize your settings to get the most relevant notifications for your situation.

Contact one of the three major credit bureaus to place a fraud alert on your credit file. The bureau you contact will notify the other two bureaus automatically. This alert requires creditors to take extra steps to verify your identity before approving new credit.

Fraud alerts last for one year and can be renewed if needed. You can also request an extended fraud alert that lasts seven years if you’re a victim of identity theft. These alerts provide additional protection when someone tries to use credit in your name.

Keep records of any data breach notifications you receive from companies holding your personal information. These notices may entitle you to free credit monitoring services under Massachusetts law. Contact the company if they don’t automatically provide required monitoring services.

Watch for signs that your personal information may have been compromised in unreported breaches. Monitor your credit report every few months for new accounts or inquiries you didn’t authorize. Report suspicious activity to the appropriate credit bureau immediately.

Free credit monitoring services have several important limitations that Boston residents should understand:

Free services don’t include advanced features like dark web monitoring or social security number tracking. You won’t receive alerts about your personal information being sold on illegal marketplaces. These services focus primarily on credit report changes rather than broader identity protection.

Most free credit monitoring services provide limited customer support compared to paid alternatives. You may have difficulty reaching representatives when you need help with alerts or disputes. The resolution process for identity theft issues can be more complex without dedicated support.

Free services typically don’t offer credit score simulation tools or personalized improvement recommendations. You get basic monitoring without the educational resources that help improve your credit score. This limitation affects your ability to optimize your credit profile proactively.

Boston residents should consider paid services when they need comprehensive protection or have high-risk profiles. Free options work well for basic monitoring but may not provide adequate protection for complex financial situations. You can always start with free services and upgrade if your needs change.

Yes, Boston has several organizations that provide free or low-cost credit monitoring assistance to residents. Legal aid organizations offer guidance on accessing your free credit reports and understanding your rights. These groups help you navigate the process of setting up monitoring services effectively.

Consumer affairs groups in Boston provide education about credit monitoring and identity theft protection. You can attend workshops that teach you how to use free credit monitoring services properly. These organizations also help you understand what to do if you discover fraudulent activity.

Non-profit credit counseling services in Boston offer comprehensive assistance with credit monitoring and improvement. These organizations help you interpret your credit report and set up appropriate monitoring services. You receive personalized guidance based on your specific financial situation and risk factors.

Boston-based legal aid clinics provide free assistance when identity theft or credit fraud occurs. These organizations help you dispute inaccurate information and work with creditors to resolve problems. You get professional support throughout the credit restoration process without paying expensive attorney fees.

Community organizations throughout Boston offer financial literacy programs that include credit monitoring education. You learn how to protect your credit and use free monitoring services effectively. These programs help you develop long-term strategies for maintaining healthy credit and avoiding identity theft.

Credit monitoring directly affects your mortgage approval rates by helping you maintain the high credit scores lenders require. Boston’s competitive lending market demands excellent credit for the best rates and terms. Monitoring helps you catch problems before they damage your creditworthiness during the application process.

Good credit monitoring protects against fraud that could derail home purchases at critical moments. Identity theft can destroy your credit score just when you need it most for closing. Early detection through monitoring allows you to resolve issues quickly and keep your Credit Score transaction on track.

Boston’s competitive Credit Score market requires buyers to act quickly when opportunities arise. You need pre-approved financing to make competitive offers on desirable properties. Credit monitoring ensures your credit profile remains stable and ready for immediate mortgage approval.

Monitoring services help you maintain the credit health necessary for refinancing opportunities throughout Financeship. You can take advantage of falling interest rates or access home equity when your credit remains strong. This flexibility provides significant financial benefits over the life of your mortgage.

Free credit monitoring protects your ability to qualify for investment property financing in Boston’s lucrative rental market. You maintain the credit profile needed for multiple mortgage approvals and portfolio expansion. This protection preserves your long-term Credit Score investment opportunities and wealth-building potential.

Free credit monitoring services provide essential protection for Boston residents facing increasing identity theft risks. Massachusetts law and federal regulations guarantee your access to comprehensive monitoring without monthly fees. You have powerful legal rights that most people never use to their advantage.

Your credit health directly impacts your ability to participate in Boston’s competitive Credit Score market successfully. Good credit monitoring protects your qualification status for mortgages, refinancing, and investment opportunities. Don’t let preventable credit problems destroy your Credit Score dreams and financial future.

If credit issues are already affecting your ability to sell your home through traditional methods, consider working with cash home buyers who can close quickly regardless of your credit situation. These services provide alternative solutions when credit problems make conventional sales impossible or impractical.

Take action today to set up your free credit monitoring services and protect your financial future. Your credit profile and Credit Score opportunities depend on the protective measures you implement right now. Don’t wait until identity theft or fraud damages your credit beyond easy repair.

Understanding what influences your credit score makes it much easier to interpret credit checks. Discover more insights and tips at the Finance Monitoring Guide.

(+1) 5165229807

info@financemonitoringguide.com

500 Marquette Ave NW, Suite 1200 Albuquerque, NM 87102 United States