Factors That Impact Your Credit Score Factors

Factors That Impact Your Credit Score Factors Table of Contents Many people are surprised to find their credit score dropping, even when they try to manage their money well. Small mistakes, like a single late payment, can have a big and lasting impact on your credit. You may not realize how many factors actually shape […]

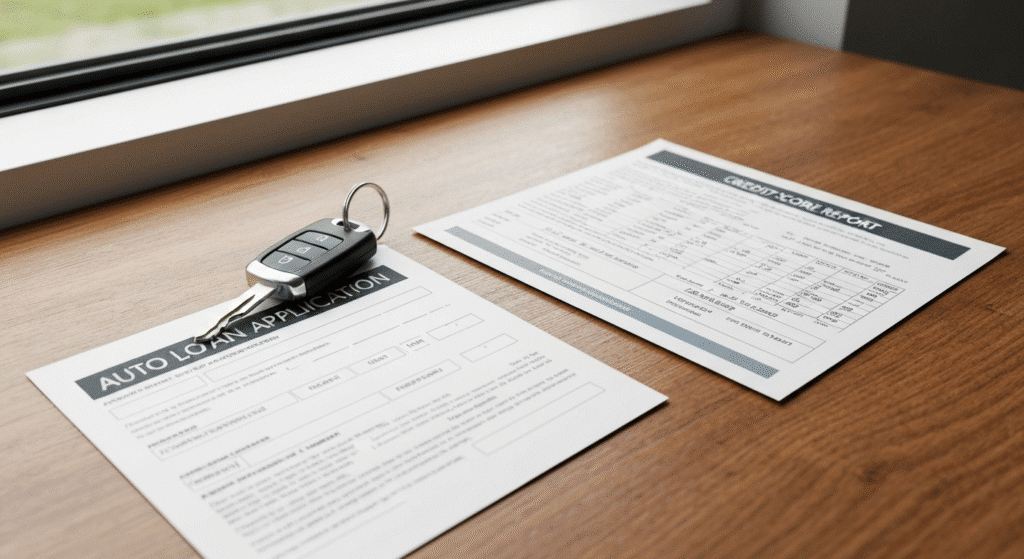

How To Get A Good Car Loan With Bad Credit

How To Get A Good Car Loan With Bad Credit? Table of Contents Getting approved for a car loan with bad credit can feel impossible. Lenders check your credit score first and often reject poor applications. Many people give up or accept expensive loans because they think they have no other options. If you accept […]

How to Restore Your Credit Score

How to Restore Your Credit Score? Table of Contents A low credit score can make life harder. It might cause higher interest rates or loan rejections. Many people feel stuck and unsure how to fix it. This problem can affect your ability to rent, buy a car, or even get a job. Every day, poor […]

How Does Credit Repair Work? A Complete Guide

How Does Credit Repair Work? A Complete Guide Table of Contents Having a low credit score can be hard. It can keep you from getting the things you want or need. Credit repair is a step-by-step way to fix mistakes or negative items on your credit report over time. This can help your credit score […]

What is a Credit Score and How Does it Work?

What is a Credit Score and How Does it Work? Table of Contents Your credit score is an important financial tool. It shows how well you manage money. This three-digit number comes from your credit report. Lenders use it to see your credit risk based on your past credit history. When you apply for a […]

How Do I Check My Credit Score? A Simple Guide

How Do I Check My Credit Score? A Simple Guide Table of Contents Your credit score plays a big role in your life. It can affect if you can get a house, your insurance rate, and other money matters. Your credit report shows a list of your past money habits. It includes payment records and […]

What Credit Score Is Needed for a Personal Loan?

What Credit Score Is Needed for a Personal Loan? Table of Contents Getting a personal loan can be stressful if you do not know what credit score you need. Many people worry about being denied or getting high interest rates. Your credit score affects whether you qualify and how much you will pay. If you […]

How Much Are Credit Repair Services

How Much Are Credit Repair Services? Table of Contents Credit repair services promise a fresh financial start, but their costs can be confusing. Many people do not know what they are really paying for. Companies use different pricing methods, which can make it hard to compare options or plan a budget. This confusion often leads […]

What Is a Good Credit Score for an Auto Loan?

What Is a Good Credit Score for an Auto Loan? Table of Contents When you need to buy a car, your credit score plays a vital role in the financing process. This three-digit number is one of the most important factors that lenders review when you apply for an auto loan. It directly influences not […]

Top 5 Credit Score Mistakes to Avoid

Top 5 Credit Score Mistakes to Avoid Table of Contents Many people work hard to manage their money, but their credit scores still drop for reasons they do not expect. Closing an old credit card or missing a small payment can lower your score, even if you pay most bills on time. Credit scoring can […]