In today’s digital world, Wisconsin residents face growing risks from identity theft, credit fraud, and unauthorized financial activity. Every year, thousands of dollars are lost across the state due to fraudulent credit use and stolen personal information. To combat these threats, free credit monitoring services play a vital role in protecting your financial health.

Backed by federal protections under the Fair Credit Reporting Act (FCRA) and supported by Wisconsin agencies like the Department of Financial Institutions (DFI) and the Bureau of Consumer Protection, residents can access no-cost resources to track changes in their credit reports. These services provide alerts about suspicious activity, help identify errors, and ensure you stay informed about your credit profile—without the burden of monthly fees.

For Wisconsin residents, free credit monitoring isn’t just a convenience—it’s a powerful safeguard against fraud and an essential step toward financial security.

Attention: Your personal information faces constant threats from identity theft and fraudulent activity. Wisconsin residents lose thousands of dollars annually to credit fraud and unauthorized account activity.

Interest: Wisconsin state agencies provide specific guidance and consumer protection resources. The Wisconsin Department of Financial Institutions and Bureau of Consumer Protection offer comprehensive support for residents seeking credit monitoring solutions.

Desire: Free credit monitoring can save you money while protecting your credit health. These services help you stay on top of credit report changes and detect signs of identity theft before major damage occurs. You can monitor your credit without paying expensive monthly fees.

Action: Wisconsin residents have access to multiple free credit monitoring services through federal law and state resources. You can start protecting your financial future today by learning about these no-cost options. Take action to help secure your credit profile and personal information right now.

Free credit monitoring services track changes to your credit reports and alert you to suspicious activity. These services monitor account activity, new credit applications, and information on your credit report from the three major credit bureaus.

The Fair Credit Reporting Act gives consumers rights to access their credit information. This federal law ensures you can obtain your free credit report and monitor your credit without excessive costs. Credit monitoring services work by scanning your credit file for changes and sending alerts when new information appears.

When you sign up for free credit monitoring service, the system tracks hard inquiries and account information. You get notified about potential fraud, new credit accounts, and score changes. The service helps protect your accounts by alerting you to unauthorized activity that may indicate identity theft.

Yes, Wisconsin residents can access multiple free credit monitoring options. The Wisconsin Department of Financial Institutions confirms that residents have legal rights to free credit reports and monitoring services.

Wisconsin’s Bureau of Consumer Protection provides guidance on obtaining these services at no cost. Federal law requires credit reporting companies to provide free access to your credit information. The centralized website www.annualcreditreport.com offers free reports from all three credit reporting agencies.

Wisconsin state agencies support these federal protections with additional consumer resources. You can access free credit monitoring through TransUnion, Experian, and other companies that provide legitimate services to Wisconsin residents.

Visit www.annualcreditreport.com to request your free credit report online. This centralized website provides secure access to reports from Equifax, Experian, and TransUnion. You receive one free credit report each year from each bureau.

Call the toll-free number (+1) 5165229807 to request your annual credit report by phone. This toll-free service operates 24 hours a day for your convenience. You’ll need your social security number and date of birth for verification.

You can request a free copy of your credit report through mail using the official form. Wisconsin DFI guidance explains this process for residents who prefer written requests. Allow additional time for processing when using mail requests.

The three major credit reporting agencies must provide these reports under federal law. You can obtain a copy from each bureau once per year at no charge.

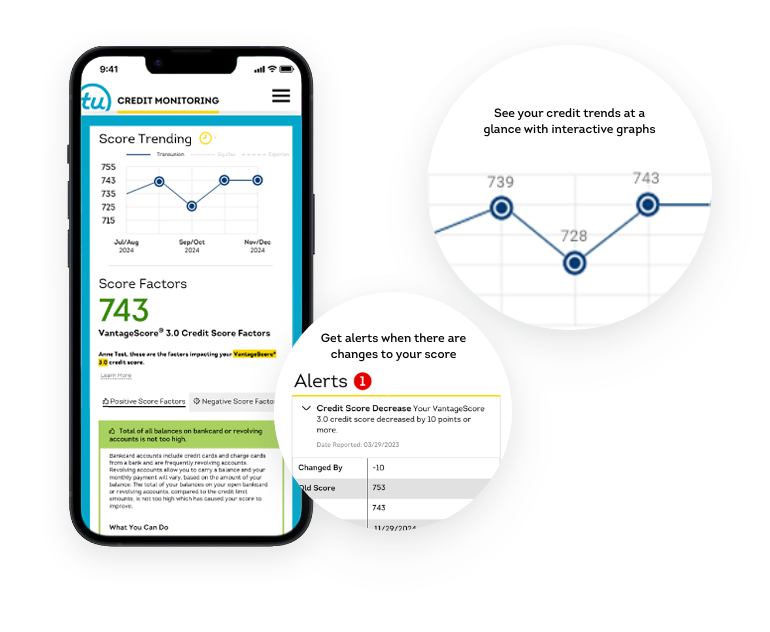

Credit bureau monitoring services provide ongoing surveillance of your credit file beyond annual reports. TransUnion offers free credit monitoring and alert services that track changes to your TransUnion credit report. This service sends notifications about new accounts, inquiries, and other credit activity.

Experian provides a free credit monitoring service for changes to your Experian report. You can sign up for alerts about account activity and potential fraudulent activity on your credit profile. These services complement your annual free credit report by providing ongoing monitoring throughout the year.

The three credit reporting agencies offer various free monitoring tools. These services help you check their credit reports more frequently than once per year. You can combine multiple free services for comprehensive coverage of your credit history.

A fraud alert requires creditors to verify your identity before opening new credit in your name. This layer of security helps prevent unauthorized account creation and protects against identity theft. The alert stays on your credit file and notifies potential creditors to take extra verification steps.

Contact any one of the three major credit bureaus to place a fraud alert. The bureau you contact must notify the other two agencies automatically. You can place a fraud alert by phone, online, or through written request to the credit reporting agency.

Wisconsin DATCP provides guidance on fraud alert procedures for state residents. The alert remains active and helps protect your accounts from unauthorized access. This free service provides essential identity theft protection without monthly fees.

Yes, Wisconsin residents can freeze their credit reports at no cost. A security freeze prevents new accounts from being opened without your permission. This protection stops creditors from accessing your credit report for new credit applications.

You must contact all three major credit reporting agencies separately to place a complete freeze. Each bureau – Equifax, Experian, and TransUnion – requires individual requests for security freeze placement. Wisconsin DATCP guidance explains the freeze process for state residents.

The freeze remains in place until you lift it temporarily or permanently. You control access to your credit file and can unfreeze it when applying for legitimate credit. This free service provides the strongest protection against unauthorized credit accounts.

Wisconsin residents benefit from both federal protections and state-level consumer support. These free services provide essential monitoring without the expense of premium plans.

Free credit monitoring service options still provide essential protection for your credit file. You can combine multiple free services to create more comprehensive coverage. The core monitoring features help detect suspicious activity and protect your personal information effectively.

You can request a free credit report when denied credit, insurance, or employment based on credit information. This right applies when the creditor uses your credit report or credit score in their decision. You must make this request within 60 days of the denial notice.

Contact the credit reporting agency that provided the report used in the denial decision. The creditor must tell you which bureau provided the information in their denial notice. You can request this additional free report beyond your annual credit report allowance.

Consumer Financial Protection Bureau rules require creditors to provide specific information about denial reasons. You need the denial notice and your personal information to request the free report. This process helps you understand why you were denied credit and identify any errors.

Wisconsin Department of Financial Institutions provides consumer education about credit reports and monitoring services. This state agency offers guidance on obtaining free credit reports and understanding your rights under federal law. They help Wisconsin residents navigate the credit monitoring process effectively.

Wisconsin DATCP gives comprehensive guidance on identity theft protection and credit monitoring options. This agency provides resources for consumers who may be a victim of identity theft or fraud. They offer complaint filing services and educational materials about credit protection.

State-level consumer protection complements federal services by providing local support and resources. Wisconsin agencies help residents understand their options and connect with appropriate services. You can contact these agencies for assistance with credit monitoring questions and identity theft concerns.

For support, contact Wisconsin Department of Financial Institutions or visit their website for credit report guidance. Wisconsin DATCP offers identity theft resources and consumer protection services for state residents.

Wisconsin residents have access to comprehensive free credit monitoring services through federal law and state resources. You can obtain your annual credit report, set up bureau monitoring, and place fraud alerts without paying fees.

Start your credit protection journey by visiting AnnualCreditReport.com for your free reports from all three credit reporting agencies. Consider signing up for free monitoring services from TransUnion and Experian to track ongoing changes. Use Wisconsin DFI resources for additional guidance and consumer protection support.

Take control of your credit health today by requesting your free credit report and setting up monitoring alerts. These free services provide essential protection against identity theft and help you maintain accurate credit information throughout the year.

Understanding what influences your credit score makes it much easier to interpret credit checks. Discover more insights and tips at the Finance Monitoring Guide.

(+1) 5165229807

info@financemonitoringguide.com

500 Marquette Ave NW, Suite 1200 Albuquerque, NM 87102 United States