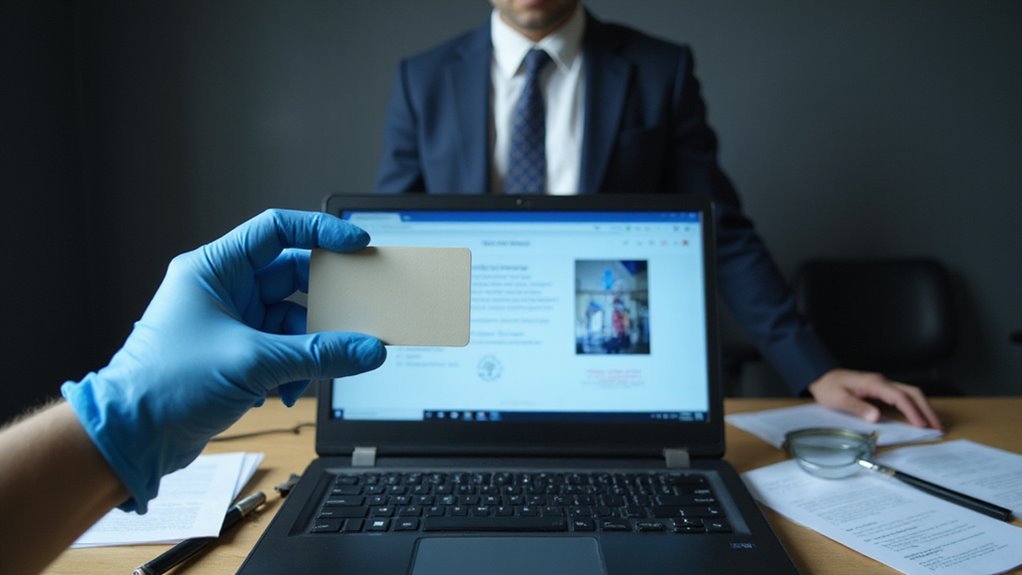

Many people struggle with damaged credit or want more privacy when applying for loans. They may search for ways to protect their personal information, especially when their credit history holds them back. The idea of a Credit Privacy Number (CPN) often comes up as an easy fix.

However, choosing a CPN can lead to serious trouble. These numbers are often marketed as legal substitutes for Social Security Numbers. In reality, using a CPN on credit applications can be risky and sometimes illegal. Many people fall for scams and end up in legal or financial trouble.

A Credit Privacy Number (CPN) is not a legitimate or legal way to rebuild or protect your credit profile. Instead, focus on proven and lawful steps to improve your credit. This blog will guide you through safe, effective ways to protect your credit and privacy.

A Credit Privacy Number (CPN) is not a legal substitute for your Social Security Number (SSN). Some people claim CPNs can protect your privacy. Regulatory agencies warn that using a CPN instead of your SSN can be fraud. If you use a CPN on credit forms, you could face legal trouble. The government does not issue or approve CPNs. Any business offering CPNs as protection is misleading you.

You should follow legal guidelines for identity theft protection. Always use safe and approved ways to guard your personal information. Instead of risky alternatives like CPNs, it is important to monitor your credit reports regularly to ensure your information is accurate and protected. Services such as credit monitoring can help you detect suspicious activity and manage your credit health safely.

You need to understand that a CPN and a Social Security Number differ significantly in issuance, legal status, and regulatory recognition. While a Social Security Number is government-issued for identification and tax purposes, a CPN is not authorized for these uses and lacks federal validation. It’s crucial to recognize these distinctions, as misuse of either number implicates privacy, security, and legal compliance concerns.

Since credit bureaus like TransUnion, Experian, and Equifax each have unique data collection and reporting standards, using a CPN can result in inconsistent or incomplete credit profiles and may alert lenders to potential fraud. Understanding the differences between a CPN and a Social Security Number can help you make better financial decisions regarding your credit and identity.

A Social Security Number (SSN) is issued by the government. It is a legal way to prove your identity. You need an SSN for taxes, work, and government benefits. A Credit Privacy Number (CPN) is not issued by any government agency.

Private companies or people make and sell CPNs. If you use a CPN instead of your SSN, it is against the law. The government says using a CPN on credit applications is fraud. You could face legal trouble or criminal charges if you use a CPN in place of an SSN.

A Social Security Number (SSN) is required for tax, employment, and government benefits. Federal law regulates its use. If a form asks for your SSN, you must provide it. You cannot use a Credit Privacy Number (CPN) instead. Some people try CPNs to rebuild credit or prevent identity theft. CPNs are not valid for official identification. Using a CPN in place of an SSN can break the law. If you misuse a CPN, you may face legal trouble. Always know the difference before using either number.

Both Credit Privacy Numbers (CPNs) and Social Security Numbers (SSNs) are used for identification. However, they have different purposes. An SSN is a government-issued number linked to your legal identity and records. A CPN is not issued or recognized by the government. Using a CPN can lead to privacy and security problems.

If you use a CPN, you could face fraud charges, since agencies like the FTC warn against them. CPNs do not have official verification or legal protections. This makes you more open to identity theft and legal trouble. Always know the difference to keep your information safe and follow the law.

Credit Privacy Numbers (CPNs) started as an alternative to Social Security Numbers (SSNs) in credit applications. CPNs appeared because people worried about identity theft and privacy issues with SSNs. Their purpose was to separate SSN information from credit checks and offer more privacy. Some people say CPNs help protect victims or witnesses, but no federal law allows CPNs for normal credit use.

The Federal Trade Commission and Social Security Administration warn that using CPNs instead of SSNs on credit forms is not legal. If someone uses a CPN for credit, they risk legal problems. It is important to remember that credit reports contain sensitive personal and financial information, and any attempt to bypass proper identification methods can result in serious consequences. Since creditworthiness factors such as payment history and account status are tracked through official identification, using a CPN can lead to inaccurate records and undermine data accuracy.

Start Free Credit Monitoring Now

You’ll often encounter CPN providers advertising instant credit approval, the ability to establish a new credit identity, and guaranteed debt erasure. These claims directly contradict established regulatory guidelines and pose significant legal risks. It’s essential to recognize that such assurances lack support under federal law and may expose you to criminal liability.

Mortgage lenders instead assess your eligibility based on credit score requirements for home buying, which cannot be bypassed with a CPN or alternative identity. Understanding the impact of paying off student loans on your credit score can help you make informed decisions about your credit health without resorting to risky methods like CPNs.

CPN providers often say you will get instant credit approval. They do this to attract people who want fast credit. If you see these promises, be careful. Real lenders check your credit using your Social Security number. They do this to follow the law and prevent fraud. Using a CPN skips these checks and breaks important rules. If you use a CPN instead of your real number, you may face legal trouble. You could also risk identity theft or lose your chance for real credit.

Some CPN providers say you can get a “fresh credit identity” with a CPN. They promise you can leave your old credit history behind. This means you could avoid old debts or poor credit. However, this is not true. The law does not support using a CPN to start over. If you use a CPN created from stolen or fake Social Security numbers, you risk identity theft charges.

Credit agencies watch for unusual activity and can spot fraud. If you use a CPN for a new credit file, you could face legal trouble. Regulatory authorities may investigate and penalize you. You could also damage your credit for years. If you want to improve your credit, you should use legal methods.

CPN providers try to make people believe their debts can disappear. They promise that using a Credit Privacy Number will erase your debt. If you want financial relief, these claims may sound tempting. However, these promises often break the rules and can be risky.

If you trust these claims, you could face legal or financial trouble.

Many companies advertise Credit Privacy Numbers (CPNs) as a way to hide or repair your credit history. They often claim CPNs offer a “new start” or “clean slate.” If you are struggling with bad credit, these offers can seem appealing. However, regulatory agencies warn that such promises are misleading and risky. These marketers target people with financial troubles by offering quick and easy solutions. Unlike legitimate credit building tools, CPNs do not help improve your financial standing and can actually put you at risk for legal trouble.

| Marketing Message | Regulatory Fact |

|---|---|

| “Start over with a CPN” | There is no law that allows this |

| “Protect your identity” | CPNs do not provide real safety |

| “Guaranteed approval” | There are no real guarantees |

If you see these offers, check the facts and know your legal rights before taking action. Before considering a CPN, be aware that credit repair companies must follow strict laws to protect consumers from scams and deceptive practices.

You must recognize that federal regulations do not authorize the use of Credit Privacy Numbers as a substitute for Social Security Numbers in credit applications. Many consumers mistakenly believe CPNs are legal, but this misconception can lead to severe legal exposure. If you use a CPN to misrepresent your identity, you’re at risk of criminal charges such as fraud and identity theft.

In addition, just as with origination fees that can unexpectedly increase your borrowing costs, misusing CPNs can result in unforeseen legal and financial consequences. Before considering alternatives like CPNs, it’s important to know that protective measures such as credit freezes are legally recognized and provide effective ways to prevent unauthorized credit access.

Federal rules do not accept Credit Privacy Numbers (CPNs) as legal replacements for Social Security Numbers (SSNs). You must use your SSN for financial applications. If someone uses a CPN instead of an SSN, they may break federal law. Banks and lenders are required to ask for your SSN.

The Fair Credit Reporting Act demands correct and honest identification. Using a CPN can count as fraud or lying. The FTC and SSA warn that CPNs have no legal value. If you want to avoid legal trouble, always use your SSN.

Credit Privacy Numbers (CPNs) are not legal substitutes for Social Security Numbers. Federal agencies have clearly stated this fact. Some people may say CPNs can protect your privacy or fix bad credit. However, the Federal Trade Commission and Social Security Administration disagree with these claims.

If you use a CPN on a credit application, you are not following the law. This can mislead lenders and cause problems for everyone. CPNs are often linked to illegal actions and violations. If you want to protect your privacy, you should use only legal options.

Using a CPN instead of your Social Security Number is illegal and considered fraud. Federal law bans false information on credit applications. If you use a CPN, you can face criminal charges. Law enforcement investigates and prosecutes these cases. If convicted, you may face:

If you want to avoid these risks, do not use a CPN.

Using a Credit Privacy Number (CPN) comes with serious legal and financial risks. CPNs are not recognized as legal identification. If you use a CPN instead of your Social Security Number, you may break the law. This can lead to being accused of fraud. Credit bureaus and lenders may flag your application as suspicious. Many CPNs are actually stolen or fake Social Security Numbers.

Some even belong to children or people who have died. If you use a CPN, you risk being held responsible for identity theft. Your credit report could also become inaccurate. In the end, using a CPN can damage your financial reputation and attract legal trouble. In fact, using a CPN may prevent you from accessing legitimate car loan options that rely on verified credit history and legal identification. Instead of using a CPN, it’s safer and more effective to learn about building a good credit score through legal and responsible means.

Misusing a Credit Privacy Number (CPN) can lead to serious legal trouble. Law enforcement can charge you with fraud or identity theft. If you use a CPN on credit forms, systems may flag your application. Here are four possible results if you misuse a CPN:

If you use a CPN the wrong way, you risk severe and lasting punishment. It’s also important to understand that legal protections such as the Credit Repair Organizations Act do not make it legal to use a CPN on credit applications, and misuse can bring additional scrutiny from regulators.

Financial institutions do not accept CPNs. Banks and lenders always check for real Social Security numbers on applications. They must follow strict rules to confirm each customer’s identity. If you use a CPN instead, your application may be rejected. Staff will flag anything that looks like fraud or identity theft. These companies follow KYC and AML laws, which ban fake identity numbers. Any effort to hide your real identity will raise concerns.

You need to pay close attention to official alerts from the Federal Trade Commission regarding CPNs. The FTC explicitly warns that using a CPN to misrepresent your identity on credit applications exposes you to significant legal risks, including potential criminal charges. It’s critical to recognize these regulatory warnings and understand the consequences of non-compliance.

The Federal Trade Commission (FTC) warns that Credit Privacy Numbers (CPNs) are not legal alternatives to Social Security numbers. CPNs do not offer real privacy or protection. If you use a CPN, you could face serious risks.

Using Credit Privacy Numbers (CPNs) is illegal and risky. The Federal Trade Commission (FTC) warns against using CPNs on credit applications. If you use a CPN instead of your Social Security Number, you may face fraud charges. Laws require you to provide true and verifiable information on all credit forms. Using a CPN breaks the Fair Credit Reporting Act and other federal laws. This can lead to criminal charges, fines, and damage to your credit. If you try to use a CPN to get credit, you risk legal trouble. Always follow the law and use your real information on credit applications.

If you want to repair your credit, do not use a CPN. Using a CPN can break the law and cause trouble. There are safe ways to improve your credit instead.

These legal options can help your credit without any risk of breaking the rules.

You should know that most CPN offers are illegal or fraudulent. If someone promises a “new credit identity,” be careful. Using a CPN instead of your Social Security number is against the law. Real credit repair never involves buying or making new ID numbers.

Companies that ask for upfront fees or guarantee instant approval are risky. If a business tells you to lie about your personal details, that is a red flag. Always check if the offer follows federal laws, like the Fair Credit Reporting Act. If a company does not explain how they get or use CPNs, do not trust them.

If you think you are a victim of a CPN scam, you must act quickly. Fast action can help protect your finances and identity. Follow these steps to limit possible harm:

Stay alert and follow all legal rules to protect your credit.

To protect your identity and build credit, you need to follow legal rules. Always use your Social Security number for credit applications. Using a Credit Privacy Number, or CPN, is illegal and risky. If you want to prevent identity theft, enroll in a trusted credit monitoring service. These services send alerts if they notice suspicious activity.

You should check your credit reports from all major bureaus often. If you spot errors, report them right away. Set strong passwords and turn on multifactor authentication for your accounts. Never give out sensitive information to unknown people or companies. If you see signs of a data breach, report it immediately. When you use safe practices and follow rules, you protect your identity and build good credit.

If you consider using a CPN, you should know the risks. Regulatory agencies do not approve CPNs for credit applications. If you use a CPN, you could face legal trouble and financial harm.

When you want to improve your credit, you should choose legal methods. Building good credit takes time and effort, but it is safer. If you follow proper steps, you can protect your financial future.

If you need guidance, you can use the Finance Monitoring Guide. This guide can help you track your progress and avoid scams. When you stay informed, you make better financial decisions.

Understanding what influences your credit score makes it much easier to interpret credit checks. Discover more insights and tips at the Finance Monitoring Guide.

(+1) 5165229807

info@financemonitoringguide.com

500 Marquette Ave NW, Suite 1200 Albuquerque, NM 87102 United States